WB Student Credit Card Scheme (WBSCC): The West Bengal state government has today announced student credit card scheme to encourage the students to continue education. The loan amount of Rs 10 lakh will be granted to students under this credit card scheme. West Bengal state government will be granting the loan for the students.

WB Student Credit Card Scheme (WBSCC) – Apply Online, Eligibility & Benefits

ABout WBSCC: Under the visionary leadership of Mamata Banerjee, Hon’ble Chief Minister, West Bengal, The Higher Education Department, Government of West Bengal has introduced the Student Credit Card Scheme for the students of West Bengal to enable them to pursue education without having any financial constraints. This scheme is designed to support the students to pursue secondary, higher secondary, madrasah, undergraduate and post graduate studies including professional degree and other equivalent courses in any School, Madrasah, College, University and other affiliated institutes within and outside India. Students studying in various coaching institutions for appearing in different competitive examinations like Engineering, Medical, Law, IAS, IPS, WBCS etc, can also avail the loan under this scheme. A student from West Bengal can obtain a maximum loan of Rs. 10 lakhs @ 4% per annum simple interest from the State Cooperative Bank and its affiliated Central Cooperative Banks and District Central Cooperative Banks and Public/ Private Sector Banks. 1% interest concession will be provided to borrower if the interest is fully serviced during the study period. The upper age limit for the interested students has been kept as 40(forty) years at the time of applying for loan. The repayment period shall be fifteen (15) years for any loan availed under this Credit Card including the Moratorium/ repayment holiday. For details kindly go through the Scheme given in this portal.

Key Highlights Of West Bengal Student Credit Card Scheme:

| Name of The Scheme | West Bengal Student Credit Card Cheme |

| State | West Bengal |

| Objective | Scheme shall provide a loan of up to ₹10 Lakh with an annual simple interest. |

| Official Website | https://wbscc.wb.gov.in |

| Repayment Period | Will be Update Soon |

| Application Type | Online & offline application |

Eligibility of West Bengal Student Credit Card Scheme

(a) The student seeking loan under the scheme should be an Indian national and resident of West Bengal for the last 10 years. Self-declaration by the student as appended in the application form will be accepted. A copy of application format is annexed at Annexure-I.

(b) Student must have got himself enrolled for higher studies including courses as stated in para 3 of this scheme, either within or outside the country, in the School, Madrasahs, colleges, Universities and other institutes like IITs, IIMs, IISc, IIESTs, ISIs, NLUs, AIIMSs, NITs, XLRI, BITS, SPA, NID, IIFTs, ICFAI Business School etc. or studying in various coaching institutes for appearing in different competitive examinations like Engineering/ Medical/ Law, , IAS, IPS, WBCS, SSC etc.

(c) Aspiring Student will apply online as per the format given at Annexure-I, through a web-based portal to be maintained by the Higher Education Department through the respective School/ Madrasah/ College/ University/ Institute in which he has got enrolled. The portal will have dashboard for each such student which shall be accessible to the Institutes concerned, the Department and the Bank.

(d) The interested students should not be aged more than 40 (forty) years at the time of applying for loan.

(e) The student applied for the credit card will link preferably their AADHAR Card or the Class X registration number with the concerned portal while applying to the Higher Education Department through their respective Institution.

(f) The Higher Education Department will forward the applications after due examination to the Bank for sanction and issuance of Credit Card.

(g) The concerned Bank will sanction the applications after due examination and issue the credit card in physical form based on the recommendation given by the Department and upon complying necessary formalities by the student/ guardian/ parent as required under RBI guidelines.

(h) There shall be a Nodal officer for maintaining the web-based portal at the Department, Institution and the Bank level who shall have permission to access the student’s dashboard availing loan under this scheme.

(i) The student concerned needs to upload his progress report card/ statement on completion of each semester/ year examinations.

The West Bengal Credit Card scheme was launched to approve hassle-free and collateral-free loans to students to continue their education. The loan will be approved for a simple interest of 4% on a maximum sum of Rs 10 lakh. While approval of the loan, banks are not supposed to insist the applicants for any security, intangible, or collateral security intangible. The education loan will be approved for students who wish to continue studying in West Bengal and even abroad.

Students of the above age group of 15 years can apply for the loan. Student applications will be sent to the Department of Higher Education and banks. The loan will be approved for both institutional expenses and for non-institutional expenses. Students can use the amount to buy a laptop, pay the college/hostel fee, or for study projects.

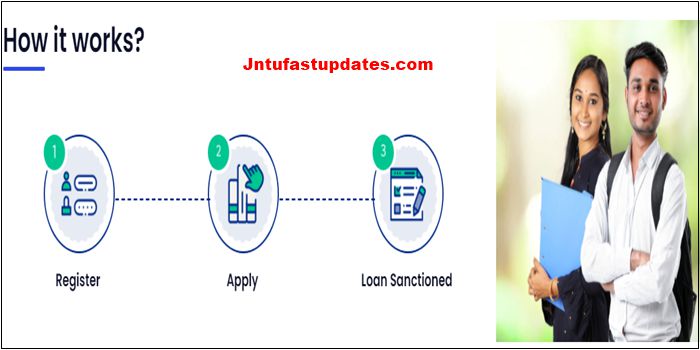

How to Apply For West Bengal Student Credit Card Scheme Online

1. Online Registration:

Visit www.wb.gov.in or banglaruchchashiksha.wb.gov.in and click STUDENT CREDIT CARD tab or Log in to https://wbscc.wb.gov.in Click on REGISTRATION OF STUDENT form option, fill up the Registration of Student form and then Click on Register button to generate user id and password.

2. Apply Loan

3. Sanctioned

West Bengal Students Credit card Required documents

- Aadhar card

- Residence certificate

- Mobile number

- Passport size photograph

- Age proof

- Ration card

- Income certificate

- Bank account details

Objective of the Scheme: – The Student Credit Card Scheme outlined herein aims at providing financial support/ assistance by the State Government at a nominal interest rate (with suitable guarantees to the bank) to the students residing in West Bengal for at least 10 years and pursuing education from class 10 onwards, or studying in various coaching institutes for appearing in different competitive examinations like Engineering/ Medical/ Law, IAS, IPS, WBCS, SSC etc., UPSC, PSC, SSC etc., and pursuing Undergraduate, Postgraduate courses including professional degree, Diploma courses and research at doctoral/ post-doctoral level or other similar courses in schools, Madrasahs, colleges, Universities and other institutes like IITs, IIMs, IIESTs ISIs, NLUs, AIIMSs, NITs, XLRI, BITS, SPA, NID, IISc, IIFTs, ICFAI Business School etc., within or outside the country, who are unable to pursue higher education due to financial constraints. The main emphasis is that students are provided with an opportunity to pursue higher education, with the financial support from the banking system with reasonable and affordable terms and conditions. Under this Scheme the aspiring students may upon fulfilling the terms and conditions detailed herein, obtain maximum loan of Rs. 10.00 lakhs at the rate of 4% simple interest from State Cooperative Banks and its affiliated Central Cooperative Banks and District Central Cooperative Banks and Public Sector/ Private Sector Banks operating in the State of West Bengal.

Quantum of loan and documentation: –

(a) Maximum amount of loan available under the Scheme is Rs. 10.00 lakhs at 4% simple rate of interest per annum, after interest subvention.

(b) For the entire amount of loan sanctioned up to Rs.10.00 Lakh, rate of interest to be charged at prevalent 3- year MCLR of State Bank of India Plus 1%. The Rate of Interest so fixed on the date of sanction will remain fixed and calculated at simple rate for the entire duration of the loan.

(c) A student can avail loan under this scheme at any time during the course of study.

(d) The bank concerned shall upload the details of the loan to the Department’s portal immediately after disbursement of the loan and such detail shall be updated by the Bank from time to time.

(e) The loan application should be submitted by the student and the parent/ legal guardian as co-borrower.

(f) Student and Parents/ Legal Guardians will enter into an agreement with the bank.

Margin Money:–

(a) Up to Rs. 4.00 Lakhs: NIL

(b) Above Rs. 4.00 Lakhs: 5%

(c) Scholarship/ Assistance ship to be included in Margin.

(d) Margin will be brought in one year to year basis as and when disbursements are made on a pro-rata basis in applicable cases.

Security:–

(a) While sanctioning the loan, the Bank should not put any unnecessary restrictions or conditions regarding collateral security etc.

(b) The Banks will not insist on any security /collateral security in tangible/ intangible form other than coobligation of the parents/ Legal guardians. The State Government will enter into an agreement with the banks separately in this regard.

Insurance: – There will be a life cover in the name of the student up to the loan amount sanctioned. The insurance premium is to be borne by the student and the same may be debited from his Loan account.

Mode of Disbursement: –

1. The amount of loan will be credited directly to the designated account of the Institution concerned in case of payment of course fees and other fees related to the Institution.

2. The amount of loan will be credited to the student’s Bank account for purchasing of Computer/ Laptop/ books/ stationeries/ living expenses etc.

Time line: – There will be time bound action for loan sanctioning and disbursement process. The Higher Education Department and the School Education Department will notify the same after due approval of the competent authority.

Repayment Holiday / Moratorium: – There will be a moratorium or repayment holiday of one year under this scheme after completion of the course or one year after getting an employment, whichever is earlier.

Repayment: –

(a) Repayment period shall be fifteen (15) years for any loan availed under this Credit Card including the Moratorium/ repayment holiday.

(b) The student or his parent/ legal guardian can repay the loan amount at any time before the stipulated period of repayment and in case of early repayment there shall be no penalty or processing cost charged by the Bank.

(c) 1% interest concession will be provided to the borrower if the interest is fully serviced during the study period.

(d) The student or the co-borrower, as the case may be, shall be liable to repay the loan on time as 1st charge.

(e) The loan will be made available at the rate of 4% p.a. simple interest rate per annum to the students. Appropriate subvention of interest rate will be provided by the State Government for all the borrowers during the entire period of the Loan to restrict the actual rate of simple interest to 4% per annum, at borrower level.

Monitoring System:-

The Higher Education Department and the School Education Department will set up a monitoring committee at the State & District levels to ensure smooth and proper implementation of the scheme & to monitor that the benefits of the scheme accrue to the students. The committee will oversee the functioning of the scheme being implemented both in government & private schools/colleges/universities, other educational institutions and different coaching centres.

Public Grievance Redressal System:- There shall be a public grievance redressal cell headed by a senior government official. Any student having complaint with the services, may either contact at toll free number 1800 102 8014 or mail at support-wbscc@bangla.gov.in

Frequently Asked Questions (FAQ)

Visit official website for the Higher Education Department https:// banglaruchchashiksha.wb.gov.in or https://wb.gov.in and click on tab STUDENT CREDIT CARD or visit https://wbscc.wb.gov.in

State Help Desk no. of the SCC scheme is18001028014 (Toll free) Support mail ID: support-wbscc@bangla.gov.in

Yes, the student will get an SMS in her/his registered mobile number

No. There is no need to furnish the copy of domicile certificate and Caste certificate.

Maximum amount of loan eligible under the scheme is Rs. 10(ten) lakhs

For More FAQ’s Check Here.

320-x100(1).gif)